Again 75 Percent of Founders Will Get Nothing for Their Equity

Early stage founders often need to brand time-sensitive fundraising decisions to propel their companies forward, still they'll freely admit that they rarely empathise the long-term implications of their decisions. We spoke with founders, investors and advisors to hear their tips for making audio fundraising decisions that you lot tin use to benchmark your own experience. At the end of this article, you'll observe tables that show how founders are diluted over the long term in different scenarios.

-- Lewis

For many entrepreneurs, a successful fundraising round is a fourth dimension to celebrate. For Ian Foley, a veteran of iv startups, it'due south ever been a fourth dimension of deep reflection.

The influx of money provides room to grow. Just it comes at the expense of control and room to maneuver later on. By the time he founded AcuteIQ in 2014, Foley had learned an of import lesson: "Merely take equally much capital as yous call up you really demand."

Figuring out how much that is, of class, is the hard part. If you raise besides much, you could give away an unduly large portion of your company. If you lot raise too fiddling, you risk running out of cash earlier you achieve the milestones needed to get back to investors again. Meanwhile, understanding the ins-and-outs of various financing instruments—convertible notes, SAFEs, equity rounds—and their long-term implications tin be daunting.

So how should you get about information technology? Start with some practiced forecasting, exercise a off-white amount of math and get help on cut through the legalese. Here'southward some communication from startup founders and advisors who've washed information technology before:

Don't enhance more you need

You lot're going to become conflicting communication on this, with some people telling yous to raise as much coin equally you tin can. The right answer will hinge on factors similar economic weather—bull run or downturn?—and the corporeality of buzz with investors your startup has generated.

Looking at it from a dilution perspective, the answer is clear: take as trivial exterior capital as you tin get away with. The money yous raise early on, "is going to be the almost expensive money you ever take," says David Van Horne, a partner in the technology practice at law house Goodwin Procter.

Your initial backers are getting equity at a time when your visitor has the least value, so each dollar invested buys a proportionally larger pale. That's true even when you use an investment vehicle like a convertible annotation or a SAFE (which stands for elementary agreement for future equity), both of which defer a decision about how much disinterestedness investors will go to a later date.

"The money you raise early on on is going to be the most expensive money you e'er accept."

To be certain, if yous raise a priced round at a high valuation, the long-term deviation in dilution between raising $250,000 through notes and, say, $750,000 won't exist much.

No early phase startup volition be able to accurately forecast all its expenses. But you lot should try. Before going out to enhance money, practise your all-time to approximate what it volition take to get your startup to the next phase, says Jim Marshall, head of SVB's emerging managing director practise.

"Map out the critical milestones that decrease gamble in the business concern," Marshall says. Once you reach that side by side stage, Marshall adds, "investors would exist willing to pay more."

Don't rely on notes for too long

Every bit you raise pre-seed funds from friends, family unit and angels, using convertible notes or SAFEs makes perfect sense. It allows you to get going speedily, without having to put a precise value on your company. Because of the added risk they assume, note and Safety holders will typically get a discount when you do your outset priced round.

Just don't go downward this road for too long. As the amount you heighten through these instruments grows, so does the pressure to raise a priced round with a high valuation. Say you've netted $500,000 through SAFEs or convertible notes, and when information technology comes to a priced round yous tin only command a $3 1000000 postal service-coin valuation, your annotation holders will own more than 20 percentage of the company, after accounting for the discount.

"The last matter a founder wants to do is give away 40, 50 or 60 percent of the visitor before they've even raised a Serial A, which I've seen many times," Marshall says.

Safety or convertible notation? Don't overthink it

Both a SAFE and a convertible notation are ways to enhance money without having to put a specific value on your company and determining how much equity the investor is getting.

Like a convertible notation, a SAFE entitles the holder to shares, often at a discount to the first priced round. Unlike a convertible note, a SAFE doesn't control interest and has no maturity appointment. Here's a helpful primer on differences between a SAFE and a convertible annotation.

Map out the disquisitional milestones that decrease risk.

But proceed in mind that as long as the terms are not out of the ordinary, going with one or the other won't materially modify your startup'south ownership structure in the long term.

SAFEs, which were pioneered by prominent incubator Y Combinator, have go increasingly pop in recent years, in role considering templates are freely available. "More and more than founders say, 'we're only going to use this form from YC,'" says Ivan Gaviria, a partner at law firm Gunderson Dettmer. "It can often salvage money in lawyers."

Utilize caps as your guide

A cap is a way for note or Condom holders to protect themselves against the dilution that would come from a startup raising a priced round at a loftier valuation, basically locking in a minimum future equity stake. A $5 million cap, for instance, would mean that a SAFE or notation holder would ain the same percentage of the visitor for any amount raised at or higher up the cap.

Founders, in general, dislike caps. It'southward increasingly rare to detect a deal without a cap, though. Ane upshot: They're useful for understanding how much a SAFE or a note will touch on dilution.

"Information technology gives you a crude judge of what impact it will accept on you," says Michael Cardamone, a manager at Acceleprise, an enterprise software focused accelerator. Remember, nevertheless, that raising below that corporeality will crusade more dilution.

Limit the options pool

You've raised your coin, now you've got to build your startup team. But exist mindful of the cost. "Don't allocate too large of an employee equity pool," says startup veteran Foley, who is now a venture capitalist.

The logic here is the same as the i that underlies the calculus almost how much you raise. If y'all give away besides much to attract specific people, yous finish up diluting yourself and your investors more than than yous demand.

Most startups reserve between 10 percentage and twenty percent of equity for their option pools.

As you split those pools among the staff you need, it'southward worth giving special thought to how much yous give to central employees early on. As a rule of thumb, a VP of engineering science or head of sales who joins at the earliest stages might go between 1 per centum and 2 percent. Other senior roles may warrant a half a percent.

"Only take equally much upper-case letter as y'all think yous really demand."

Avert super pro-ratas

Yous've just gotten a marquee investor interested, only as a condition of their investment, they insist on reserving the right to increment their stake in your visitor in future rounds, an arrangement known as super pro-rata.

"Seed investors are playing a portfolio game that involves a lot of losers," says Gaviria. "When they get the winners, they really desire to put the money behind them." While standard pro-ratas, which allow investors to maintain their current share of ownership, serve as protection from as well much dilution and are mutual, super pro-ratas could have a huge downside for your company, as they may deter new investors from coming in.

Many later-stage funds have target ownership stakes, and won't invest unless they end up with at least a ten percentage to 15 percentage pale, for example, says Cardamone. He recommends negotiating with investors who want for super pro-ratas. "At the finish of the mean solar day, a lot of investors may ask for these sorts of things but they don't desire to go in the style of having a [hereafter] round get done," Cardamone adds.

The takeaway

Much of the advice we've discussed amounts to this: practise your best to empathise what you are getting yourself into; empathise contractual terms; understand the math.

"I observe that a lot of founders are so happy to get the money that they sign without thinking through the impacts," Cardamone says.

There are various online tools to aid with the nitty-gritty of fundraising and dilution, including Capital Computer and Captable.io.

Once you've done all your homework, move quickly. Don't waste matter time optimizing for a pct more than here or a few thousand dollars more there. After all, you have a startup to run.

"It's more of import in the outset stages to get the correct people effectually the tabular array and get smart money in relatively quickly and with relatively low friction," Cardamone adds.

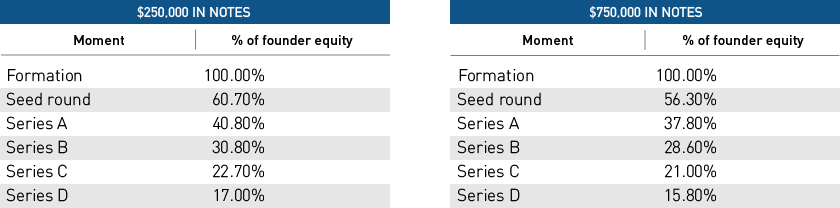

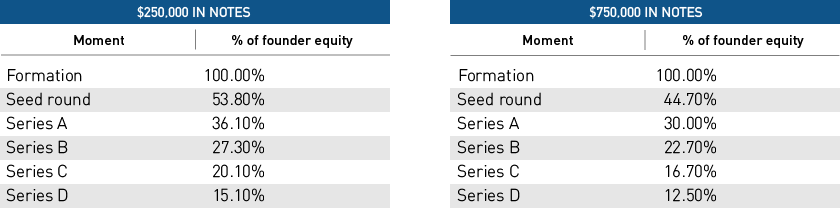

Startup equity dilution by the numbers

To show how convertible notes and SAFEs can bear on dilution over the long term, we traced the percent of a visitor a founder owns through four different scenarios. In each case, everything afterward the seed investment is the same.

Scenario 1: A company that raises a $two.5 1000000 series seed at a $10 meg post-money valuation. (Notes have a 20% discount, $8 one thousand thousand cap.)

Scenario 2: A company that raises a $1.v million serial seed at a $5 million post-money valuation. (Notes have a 20% disbelieve, $8 1000000 cap.)

Source: https://www.svb.com/startup-insights/startup-equity/startup-equity-dilution

0 Response to "Again 75 Percent of Founders Will Get Nothing for Their Equity"

Post a Comment